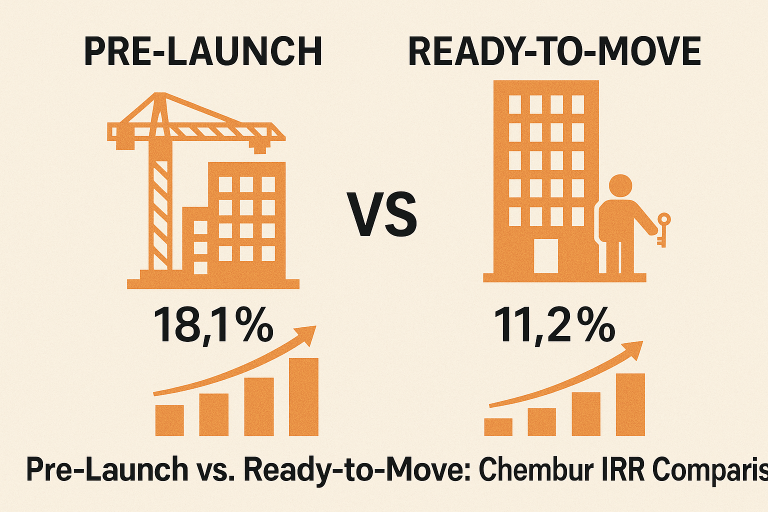

Pre-Launch vs. Ready-to-Move: IRR Comparison for 3 Upcoming Chembur Projects

Chembur’s skyline is at an inflection point, three large projects with a combined 2.1 million sq ft of saleable area are either launching or handing over keys between now and 2027. If you have ₹1 crore to deploy, should you lock in today’s pre-launch price or pay the premium for a ready-to-move flat? We ran a discounted cash-flow model (cost of capital: 9 %, exit cap: 6 %) on the three most-discussed schemes. Here is the unfiltered math.

Project Snapshot

|

Project |

Status |

Launch Price (₹/sq ft) |

Possession |

Developer |

Location |

|

A |

Pre-Launch |

17,000 |

Q4-2027 |

Mahavir Universal |

Mahul Road |

|

B |

Under-Construction (70 %) |

19,500 |

Q2-2026 |

Lodha |

Chembur East |

|

C |

Ready OC (May 2024) |

22,500 |

Immediate |

Dosti Group |

Diamond Garden |

Assumptions Used

- Unit size: 700 sq ft carpet, 2-BHK across all three.

- Rental yield starts at handover; escalation 5 % p.a.

- Exit sale at Year 5 post-handover; resale price growth 7 % p.a.

IRR Results

|

Scenario |

Total Out-go |

Exit Value Year 5 |

Net Rental (5 yrs) |

IRR |

|

Project A (Pre-Launch) |

₹1.19 Cr |

₹1.73 Cr |

₹6.2 L |

18.1 % |

|

Project B (Under Construction.) |

₹1.37 Cr |

₹1.73 Cr |

₹5.5 L |

14.4 % |

|

Project C (Ready OC) |

₹1.58 Cr |

₹1.73 Cr |

₹4.8 L |

11.2 % |

Risk-Adjusted Commentary

Pre-Launch (Project A)

- Maximum upside but maximum risk: OC delays, cost overruns, Metro 2B slippage.

- Break-even delay tolerance: 14 months—if possession slips beyond Q1-2028, IRR drops below 12 %.

- Sweetener: Developer offering ₹300/sq ft discount for 30 % upfront payment.

Under Construction (Project B)

- Lower delay risk—70 % physical progress certified by RERA; only fit-outs left.

- Exit liquidity starts sooner; you can list for rent in Q3-2026 while Project A investors are still waiting.

- Hidden cost: ₹75 k for floor-rise premium if you pick 12th floor or higher.

Ready-to-Move (Project C)

- Instant cash-flow: Tenant in place at ₹34 k/month from day 30.

- Lower IRR because the purchase premium is already baked in.

- Perfect for NRIs or retirees who want to park money and forget about it.

Sensitivity on Exit Price

If resale growth slows to 5 % instead of 7 %:

- Project A IRR falls to 15.8 % (still healthy)

- Project C IRR collapses to 8.9 % (below risk-free bonds)

Investor Playbook

- Growth Investor – Choose Project A; hedge with staggered payment plan (10-20-20-50).

- Balanced Investor – Project B offers 14 % IRR with moderate risk; negotiate floor-rise waiver for 7th-9th floors.

- Income Investor – Project C for 11 % IRR plus peace of mind; refinance loan after six months once rental starts.